Every theatre wants to raise revenue without losing audiences. The solution? Pricing that feels fair, flexible, and grounded in real data.

On Tuesday 21 October 2025, the Local Theatre Touring Alliance hosted a webinar asking:

How can we (local theatres) significantly and sustainably raise revenue from ticket sales while retaining the size, diversity and trust of our audiences?

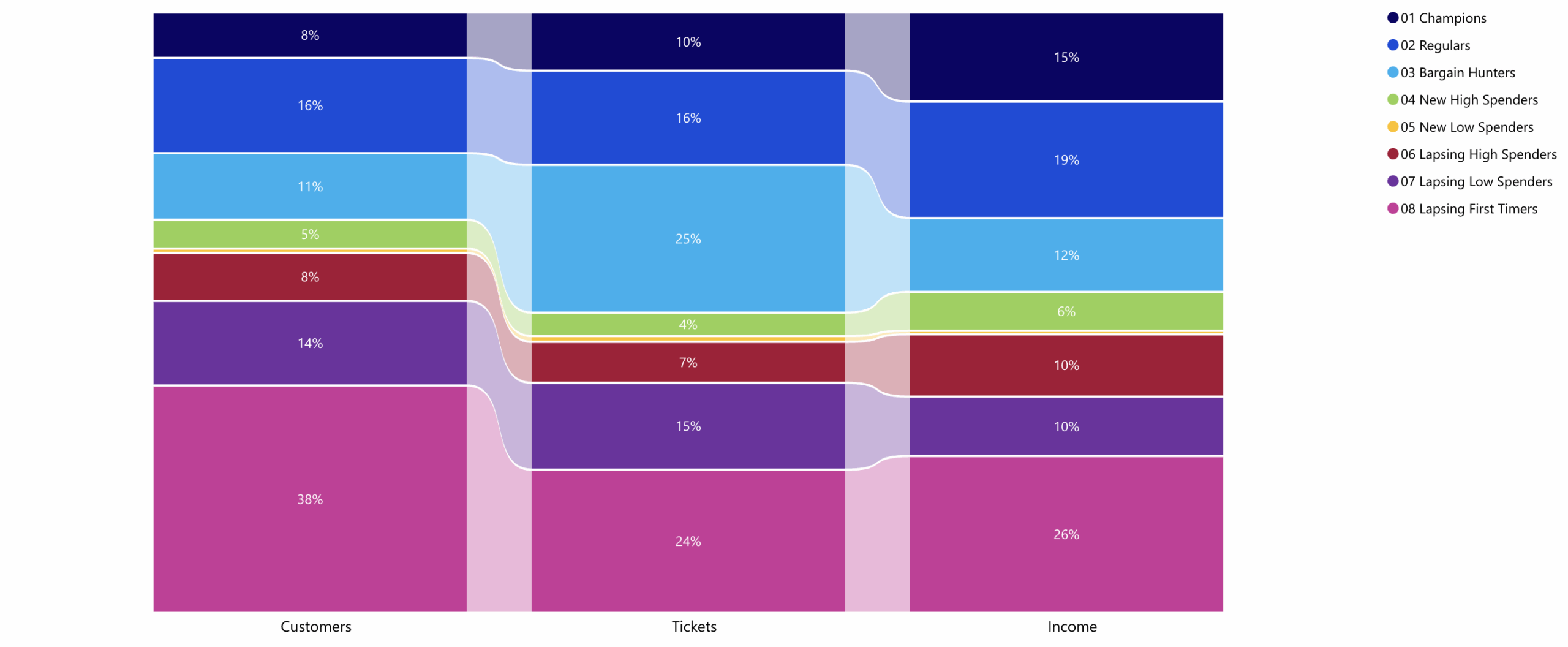

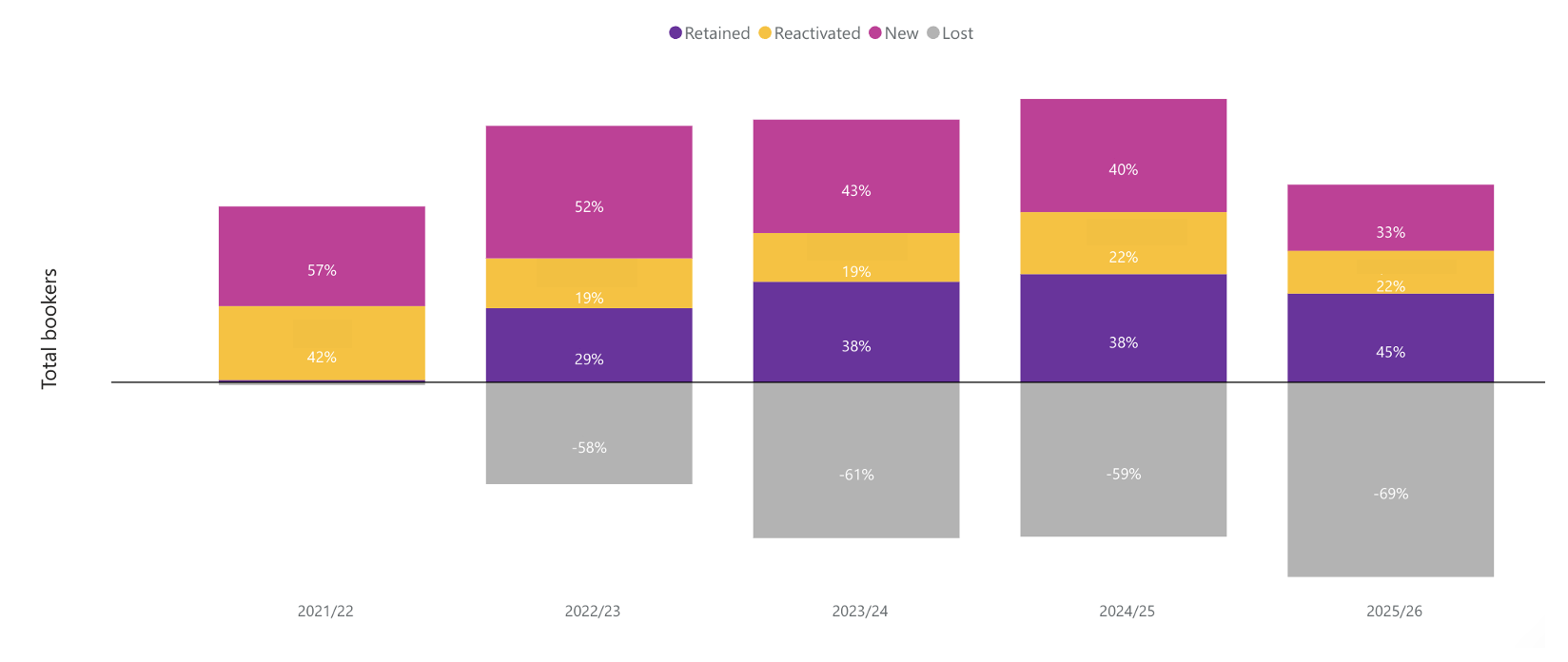

1. For venues and producers, know what % of revenue comes from your most frequent bookers

You’ve heard of the Pareto principle – better known as the 80/20 rule – which, if applied to theatre, would mean that 20% of bookers account for 80% of ticket revenue.

The reality is rarely this extreme. But it is useful to know what percentage of income comes from your most frequent attendees. The proportions vary widely in the UK. This information helps to inform your pricing and communication strategies.

It’s also helpful to bear in mind what proportion of the audience in a typical year are new to file, and so are less likely to have strongly established ideas about your pricing.

2. Strategically hedge your bets in a changing market

You’ve heard of Dynamic Pricing, but is your whole organisational strategy dynamic? We recommend that organisations facing the effects of strong market forces consider a dynamic or ‘living’ plan, as outlined for example by Mankins and Gottfredson in the Harvard Business Review (2022).

3. We can’t escape economics

To give a snapshot of what middle-and-upper earners are feeling towards theatre-going, we undertook research with 503 adults homeowners in the UK, with a reputable opinion pollster. The findings are included below:

Widely-available discount schemes

Our presentation referenced the benefits of having widely-available discount schemes for target groups, to lower price points for the audiences you most wish to engage. Examples include:

- Student Rush – Blumenthal Arts [creates a relese ‘moment’ around the release of student tickets, often well in advance of the performance date]

- ArtsCard Boston – Celebrity Series of Boston

- The Downstairs Club – Hampstead Theatre

- Barclays Dance Pass – Sadlers Wells

- Opening Year Resident Tickets – Soho Theatre Walthamstow

- Neighbourhood Theatre – Young Vic

Who books ahead?

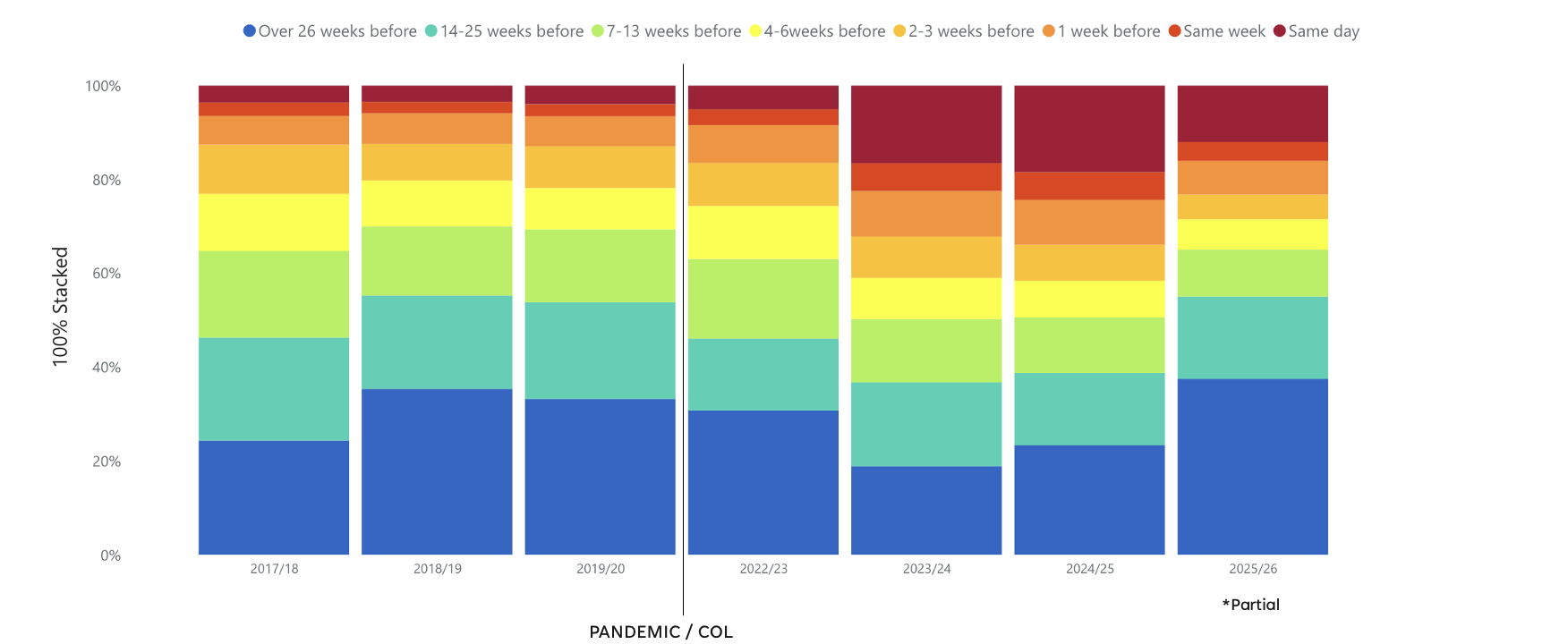

This data is accurate at scale, but can vary significantly from organisation to organisation. To illustrate the point, we’ll share data from one of our Advantage Dashboard users.

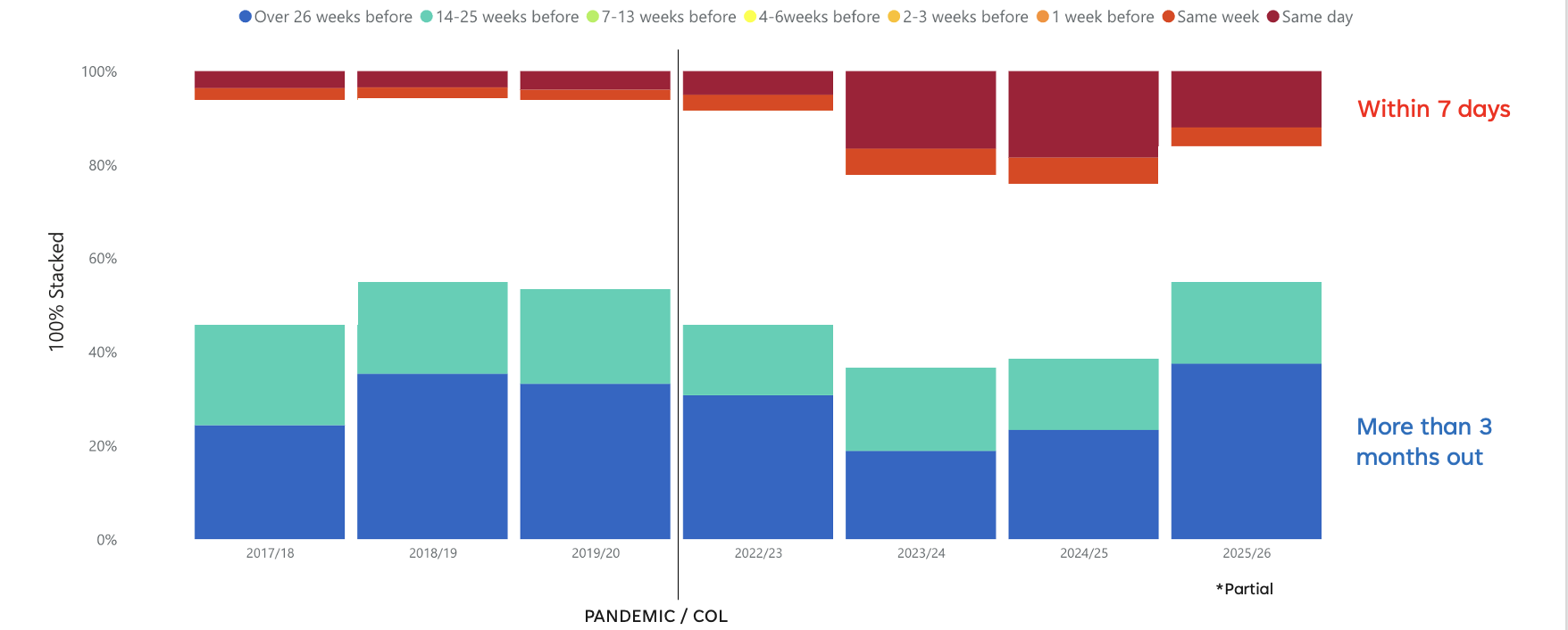

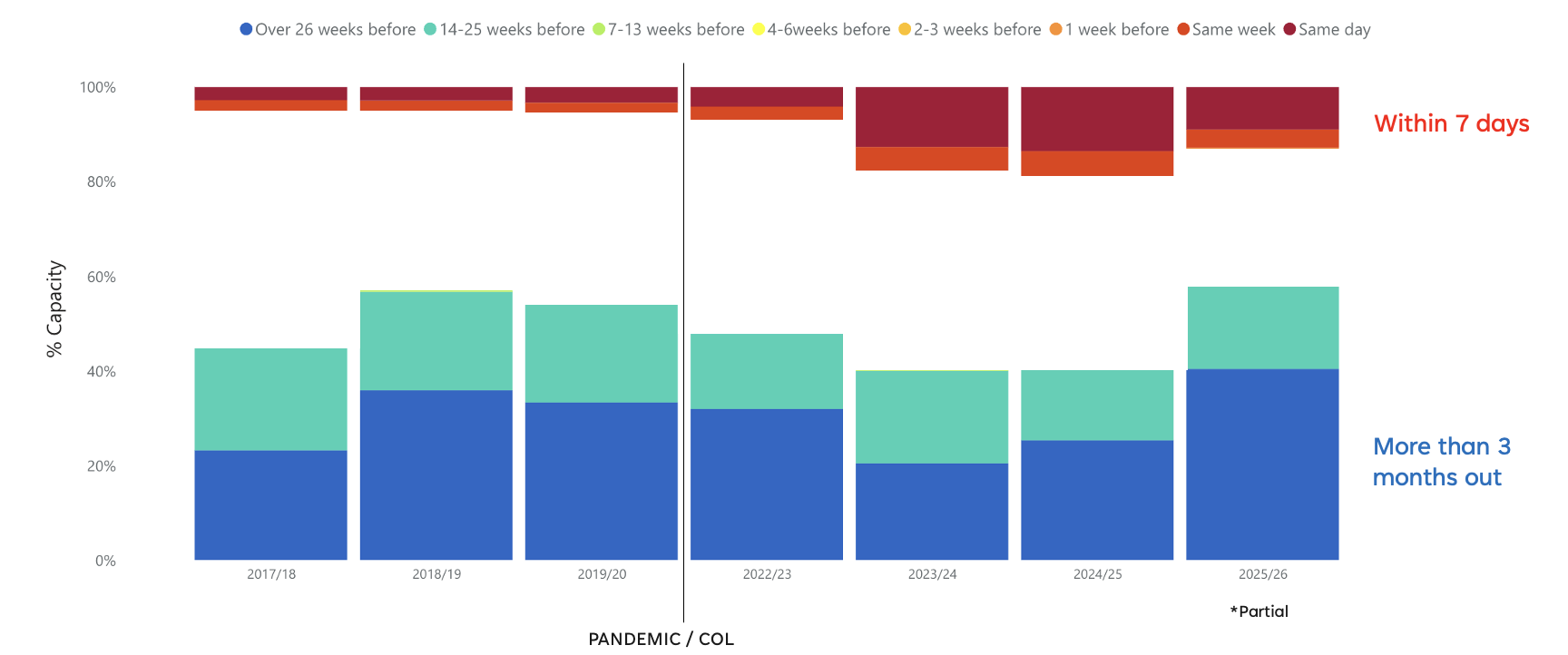

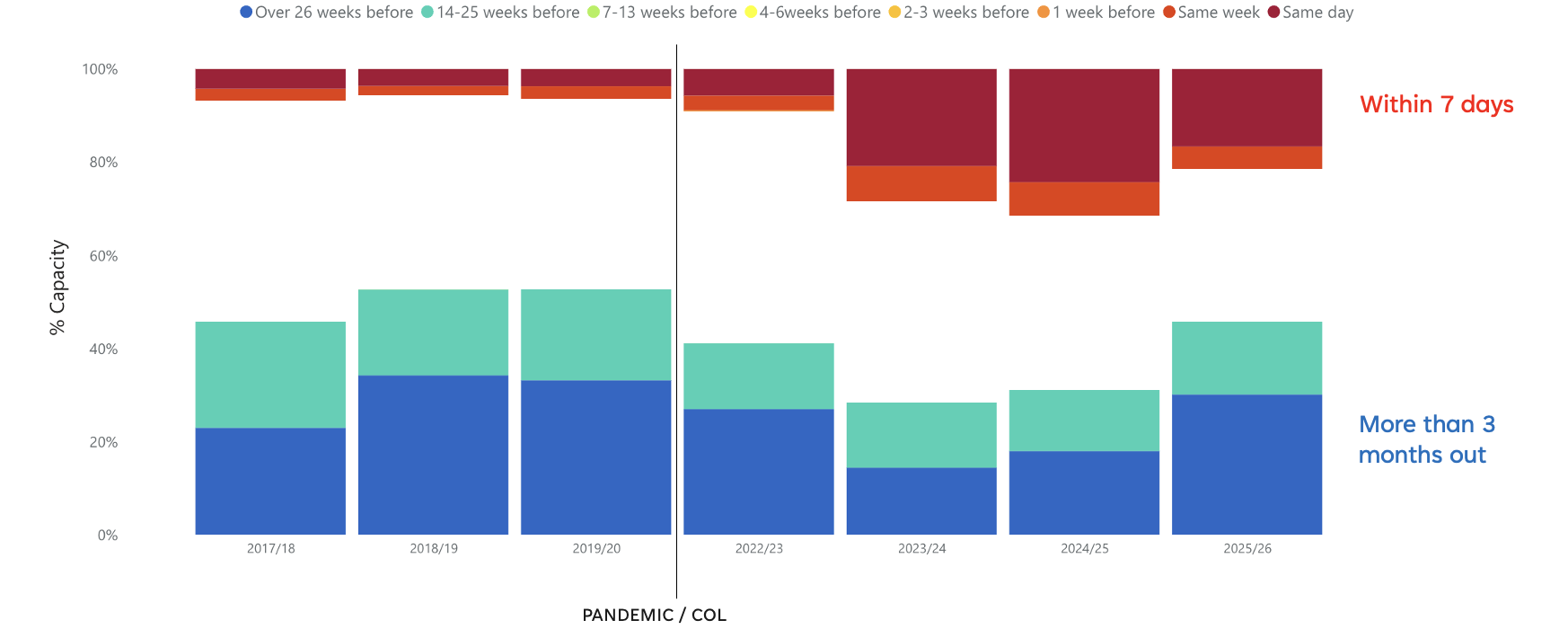

This chart shows how booking behaviour has changed in recent years. The grey line in the middle of the chart highlights the end of the pandemic, and the beginning of the Cost of Living crisis:

Lead-time charts can be overwhelming to read, and so the important thing to note is that the ‘cold’ colours towards the bottom denote people booking more than three months out, while the ‘warmer colours at the top of the chart denote people booking within 7 days of the performance:

The averages are heavily influenced by the dominance of more prosporous audience segments. So when filtering for “OAC Supergroups” (population segments) including retired professionals; surburbanites and peri-urbanites, multicultural and educated urbanites, the bars do not significantly move – the cold colours are slightly more dominant, with warm colours less prevalent:

Conversely, when filtering for OAC supergroups including low-skilled migrant and student communities, and ethnically diverse sub-urban professionals, there is an increased tendency towards booking within seven days, and a reduced tendency towards booking more than three months out.

4. Steady, gradual, increase in the average price paid is the safest way to retain the size and trust of audiences

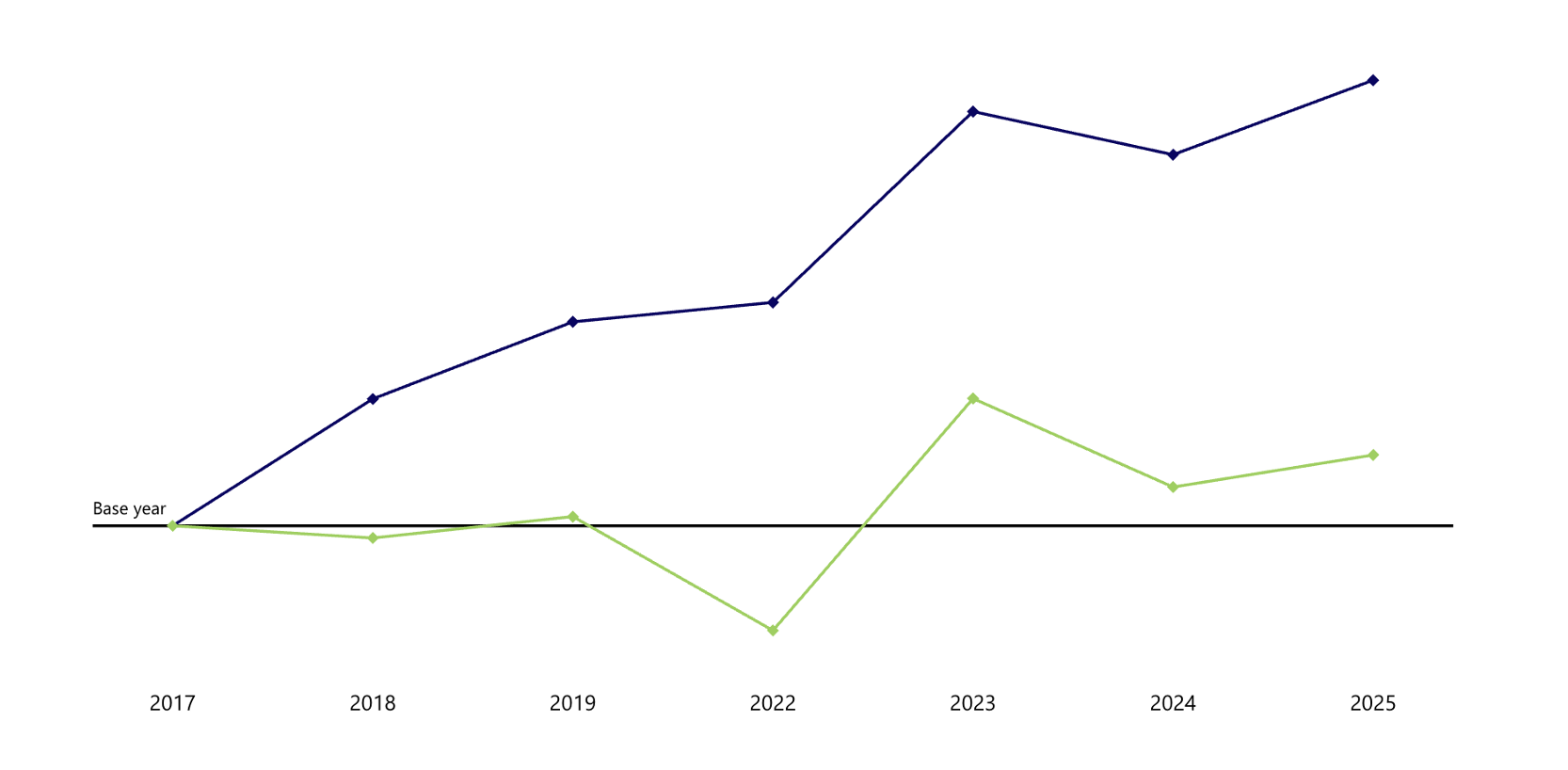

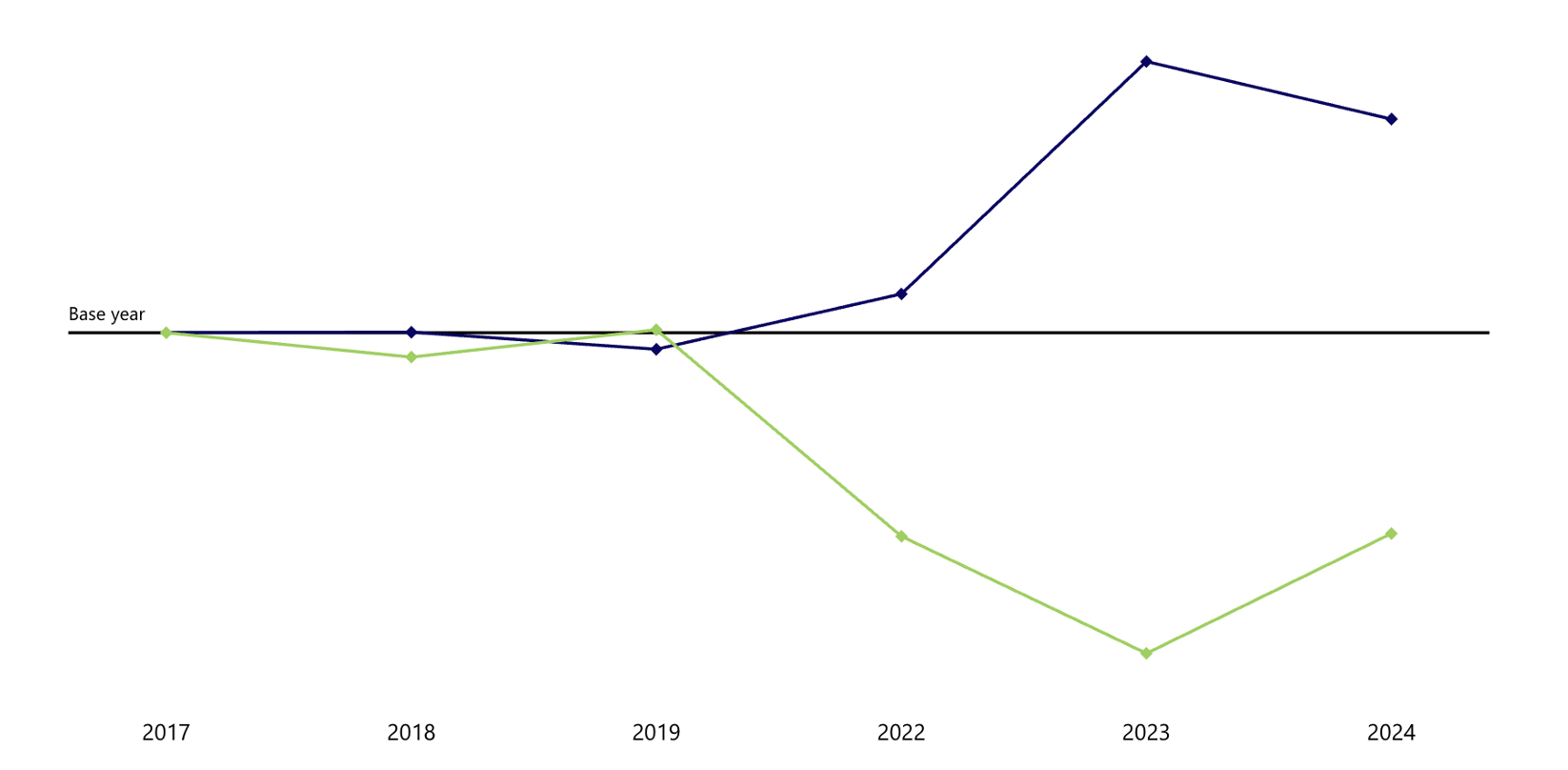

For comparison, we referenced two organisations who had both increased their average price paid (blue line on chart) by around 30% over seven years – one (left) took a steady approach, with good audience growth (green line on chart) alongside.

The other (right) made unconstrained use of dynamic pricing to effect a near-30% increase in one year, with a significant loss of bookers. A slight drop in average price paid the following year helped to begin a recovery.

5. Ask about upsells and upgrades often

We recommended that in addition to last-minute pre-booking of food and beverage through solutions such as VisitOne and crowdEngage, local theatres consider seat upgrade solutions including Preevue Seat Upgrade, and Up.

Raising revenue sustainably isn’t about squeezing audiences – it’s about understanding them. Theatres that listen, test, and evolve will find pricing becomes not a problem, but a powerful tool for resilience.